A price floor is a government or group imposed price control or limit on how low a price can be charged for a product good commodity or service.

A price floor set at 4 will be binding.

A price floor set at 4 will be binding and will result in a shortage of 6 units.

A price floor set at 16 will be binding and will result in a surplus of 12 units.

A price floor at 7 would be binding but a price floor at 4 would not be binding a price floor set at 6 50 would result in a surplus.

A price floor must be higher than the equilibrium price in order to be effective.

Governments usually set up a price floor in order to ensure that the market price of a commodity does not fall below a level that would threaten the financial existence of producers of the commodity.

A price floor set at 4 will be binding because it is higher than the equilibrium price.

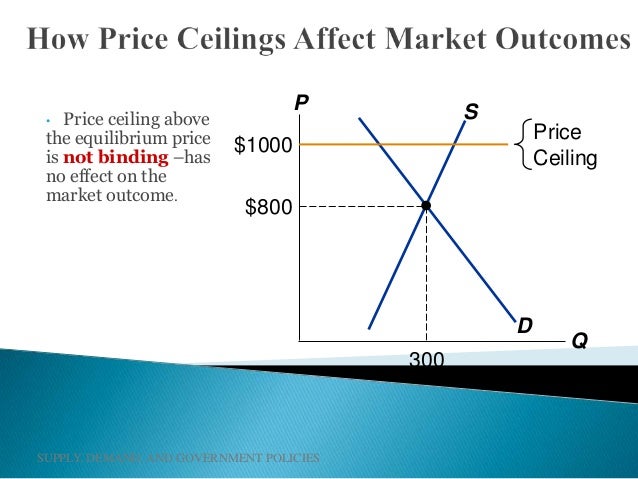

Ii non binding price ceiling.

You ll notice that the price floor is above the equilibrium price which is 2 00 in this example.

Between 50 and 100 units.

A price floor set at 7 will be binding and will result in a surplus of 12 units.

Namely marginal revenue cost will be equal to the price floor until the price floor no longer exceeds what sellers are willing to sell the good for.

A price floor set at 7 will be binding and will result in a surplus of 6 units.

Types of price floors.

A government imposed price of 6 in this market could be an example of a i binding price ceiling.

What will be the new equilibrium quantity in this market.

A price floor is an established lower boundary on the price of a commodity in the market.

A price floor set at 4 will be binding and will result in a shortage of 3 units.

A binding price floor set above the point at which the original marginal revenue cost curve exceeds willingness to pay will shift the marginal revenue cost curve but it will shift it upward.

A price floor set at 16 will be binding and will result in a surplus of 6 units.

Iv non binding price floor.

Refer to figure 6 4.

This graph shows a price floor at 3 00.

A few crazy things start to happen when a price floor is set.

Suppose a tax of 2 unit is imposed on this market.

A price floor set at 6 will be binding and will result in a surplus of 4 units.

If a binding price floor is imposed on the market for carrots then.

A binding price floor is likely to cause deadweight loss because.

The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external.

Iii binding price floor.

Simply draw a straight horizontal line at the price floor level.