A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

Are backdoor roth conversions allowed in 2018.

Can i now contribute 11000 to my ira 2018 and 2019 combined and convert all of them to roth immediately.

So if you want to convert an ira to a roth ira for 2018 and have that income included for 2018 the conversion must take place by december 31 2018.

15th in the following year if you decided that you wanted to avoid the tax hit.

See irs sets final 2018 deadline for roth conversion.

You can do a roth conversion up until dec.

Deadline for a roth conversion 2018.

I ve got my 2 acres of non leveraged crop producing cashflowing farmland via acretrader.

For 2018 the ability to contribute to a roth ira begins to phase out for singles with a modified adjusted gross income of.

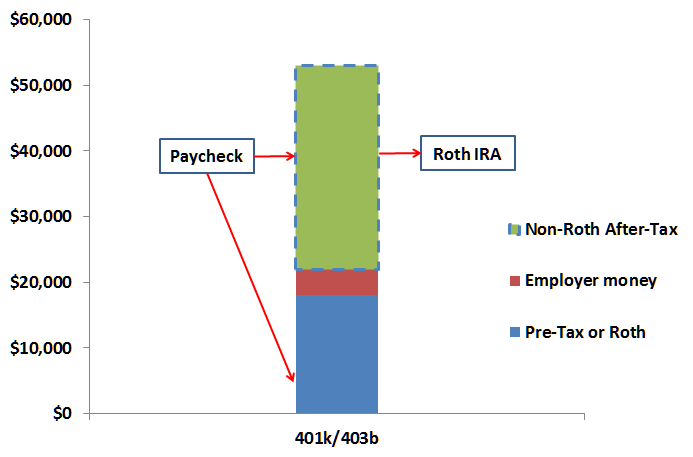

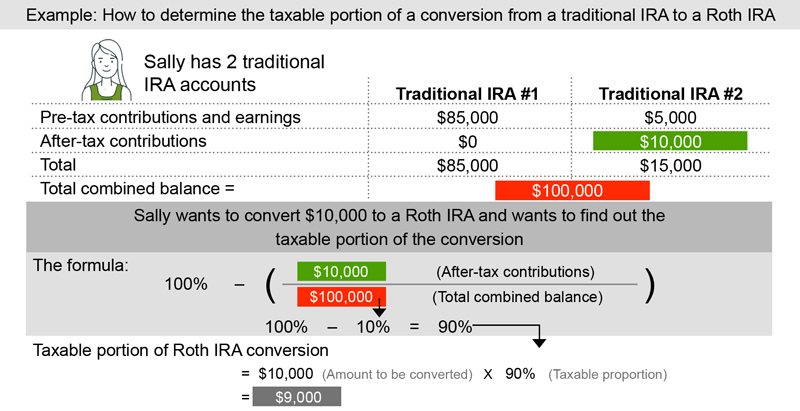

Backdoor roth ira conversions.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

I missed the 12 31 deadline for a backdoor roth conversion.

A do over meant that you could do conversion and then undo the transaction up until oct.

However you might not know your full tax.

Is this situation any different tax wise had i done the conversion before 12 31 for each year p.

In a section of the tax bill which repealed the strategy of roth recharacterizations of prior conversions congress explicitly states that while direct contributions to a roth ira are illegal for individuals with incomes above the agi limit it is legal to make a nondeductible contribution to a traditional ira and convert it to a roth ira i e.

Claim 11k roth conversion in my 2019 taxes.

More the complete guide to the roth ira.

It used to be that you could do over your roth ira conversions.

In 2018 congress officially blessed the steps of the backdoor roth as allowed under current law.

I have 0 funds in my ira right now.

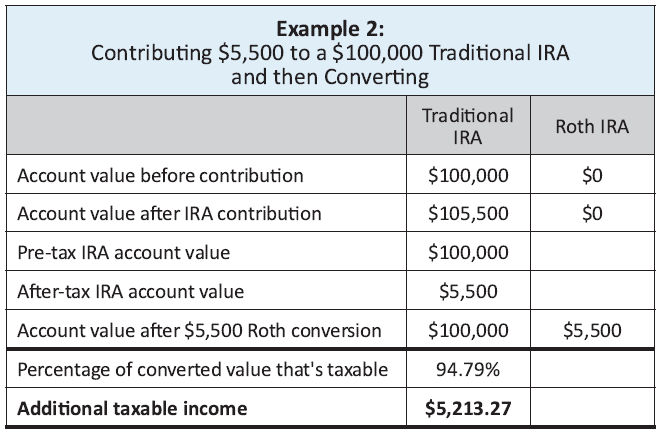

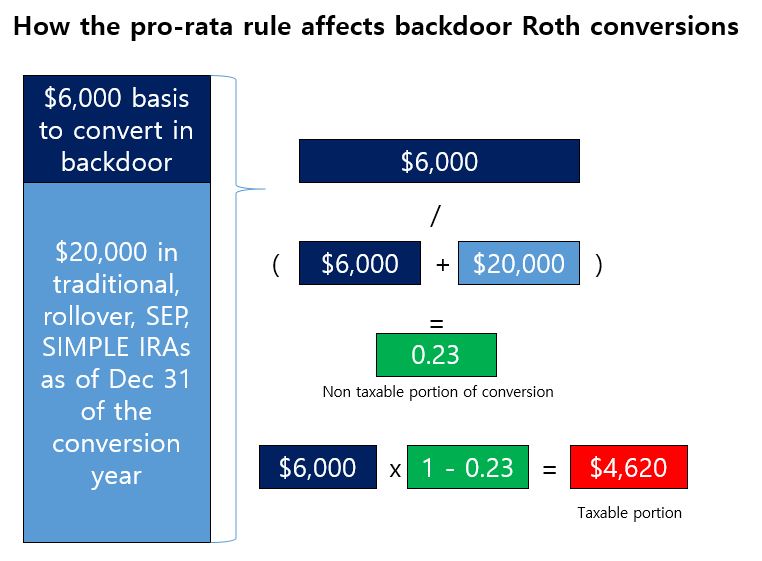

In practice that affects taxpayers with large traditional iras who are converting not those doing serial smaller backdoor roth conversions.